The 10-Second Trick For Business Insurance Agent In Jefferson Ga

Wiki Article

The Facts About Insurance Agency In Jefferson Ga Uncovered

Table of ContentsThe 7-Second Trick For Business Insurance Agent In Jefferson GaAn Unbiased View of Home Insurance Agent In Jefferson GaLittle Known Questions About Insurance Agency In Jefferson Ga.The smart Trick of Life Insurance Agent In Jefferson Ga That Nobody is Talking About

According to the Insurance Information Institute, the average annual cost for an automobile insurance coverage in the United States in 2016 was $935. 80. On standard, a solitary head-on collision can set you back countless dollars in losses, so having a policy will certainly set you back less than paying for the crash. Insurance additionally aids you stay clear of the decline of your car. The insurance safeguards you and assists you with claims that make versus you in mishaps. It also covers lawful expenses. Some insurer provide a no-claim bonus offer (NCB) in which eligible consumers can get every claim-free year. The NCB may be supplied as a discount on the costs, making automobile insurance more cost effective.

Several variables influence the expenses: Age of the automobile: Oftentimes, an older vehicle expenses much less to guarantee compared to a more recent one. Brand-new cars have a greater market worth, so they cost even more to fix or change. Parts are much easier to locate for older cars if fixings are needed. Make and design of vehicle: Some automobiles cost more to guarantee than others.

Danger of theft. Specific lorries consistently make the regularly swiped lists, so you may have to pay a higher premium if you have one of these. When it pertains to car insurance, the 3 major kinds of policies are liability, crash, and extensive. Required responsibility coverage spends for damage to one more driver's car.

The 7-Minute Rule for Home Insurance Agent In Jefferson Ga

Some states require drivers to lug this protection (http://www.video-bookmark.com/bookmark/5993400/alfa-insurance---jonathan-portillo-agency/). Underinsured motorist. Comparable to without insurance protection, this policy covers damages or injuries you suffer from a motorist that doesn't bring sufficient insurance coverage. Motorcycle insurance coverage: This is a policy especially for motorbikes because vehicle insurance policy doesn't cover motorbike accidents. The advantages of vehicle insurance far outweigh the risks as you might finish up paying countless bucks out-of-pocket for a mishap you trigger.It's generally better to have more protection than insufficient.

The Social Safety and Supplemental Security Earnings disability programs are the largest of numerous Government programs that offer assistance to people with disabilities (Business Insurance Agent in Jefferson GA). While these 2 programs are different in many methods, both are provided by the Social Safety Management and just individuals who have a disability and meet medical standards might get approved for advantages under either program

Use the Advantages Qualification Testing Device to figure out which programs might have the ability to pay you advantages. If your application has actually lately been rejected, the Internet Appeal is a starting indicate ask for a testimonial of our choice concerning your qualification for impairment advantages. If your application is refuted for: Medical reasons, you can complete and submit the Charm Demand and Appeal Impairment Record online. A subsequent analysis of workers' compensation claims and the level to which absence, spirits and working with excellent workers were problems at these companies reveals the positive results of offering medical insurance. When compared to organizations that did not supply wellness insurance coverage, it shows up that using FOCUS caused enhancements in the capability to hire excellent employees, reductions in the variety of employees' payment insurance claims and reductions in the degree to which absenteeism and efficiency were troubles for emphasis services.

Life Insurance Agent In Jefferson Ga for Dummies

Six records have actually been released, including "Treatment Without Protection: Too Little, Far Too Late," which discovers that working-age Americans without medical insurance are extra most likely to receive insufficient treatment and receive it far too late, be sicker and pass away earlier and receive poorer treatment when they remain in the healthcare facility, even for severe situations like an electric motor car collision.The research study authors additionally note that expanding insurance coverage would likely lead to a rise in genuine resource expense (despite who pays), because the uninsured obtain about fifty percent as much treatment right here as the privately guaranteed. Health Matters published the research online: "Just How Much Medical Care Do the Without Insurance Usage, and Who Spends for It? - Auto Insurance Agent in Jefferson GA."

The responsibility of giving insurance coverage for staff members can be a daunting and occasionally expensive job and lots of little services believe they can't afford it. What benefits or insurance policy do you legally need to offer?

Auto Insurance Agent In Jefferson Ga - The Facts

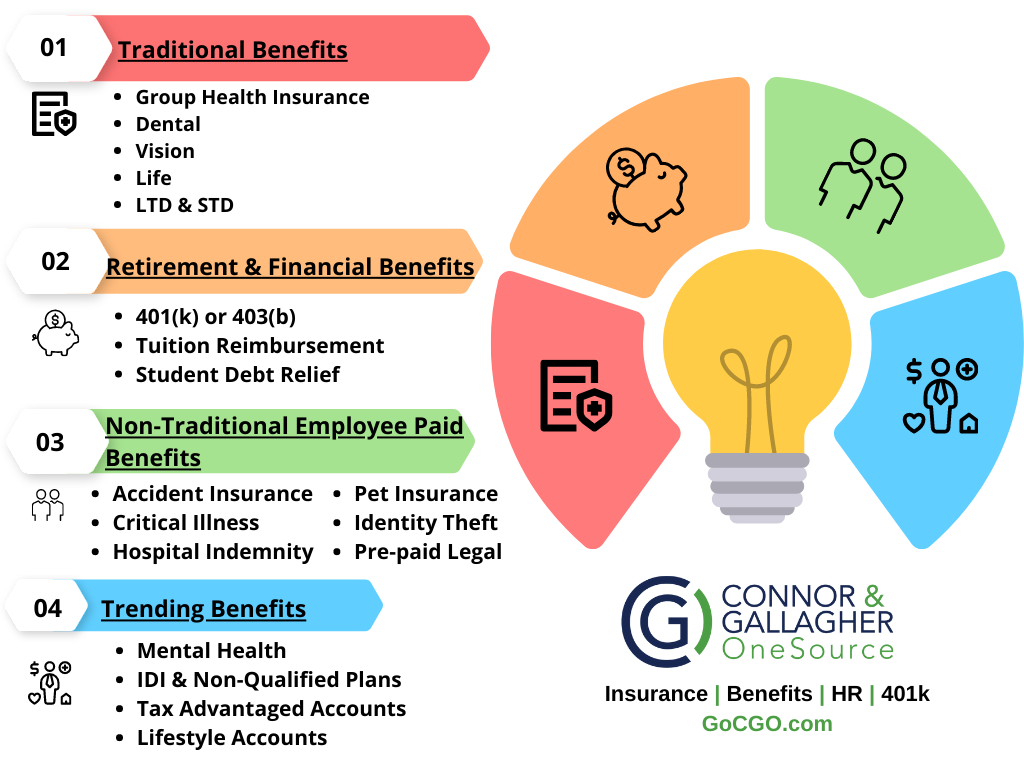

Employee benefits usually start with health insurance policy and group term life insurance coverage. As part of the health and wellness insurance coverage plan, a company might choose to give both vision and oral insurance.

With the increasing pattern in the cost of medical insurance, it is reasonable to ask workers to pay a percent of the protection. Many organizations do put most of the price on the employee when they give access to wellness insurance coverage. A retired life plan (such as a 401k, SIMPLE plan, SEP) is typically used as a staff member advantage.

Report this wiki page